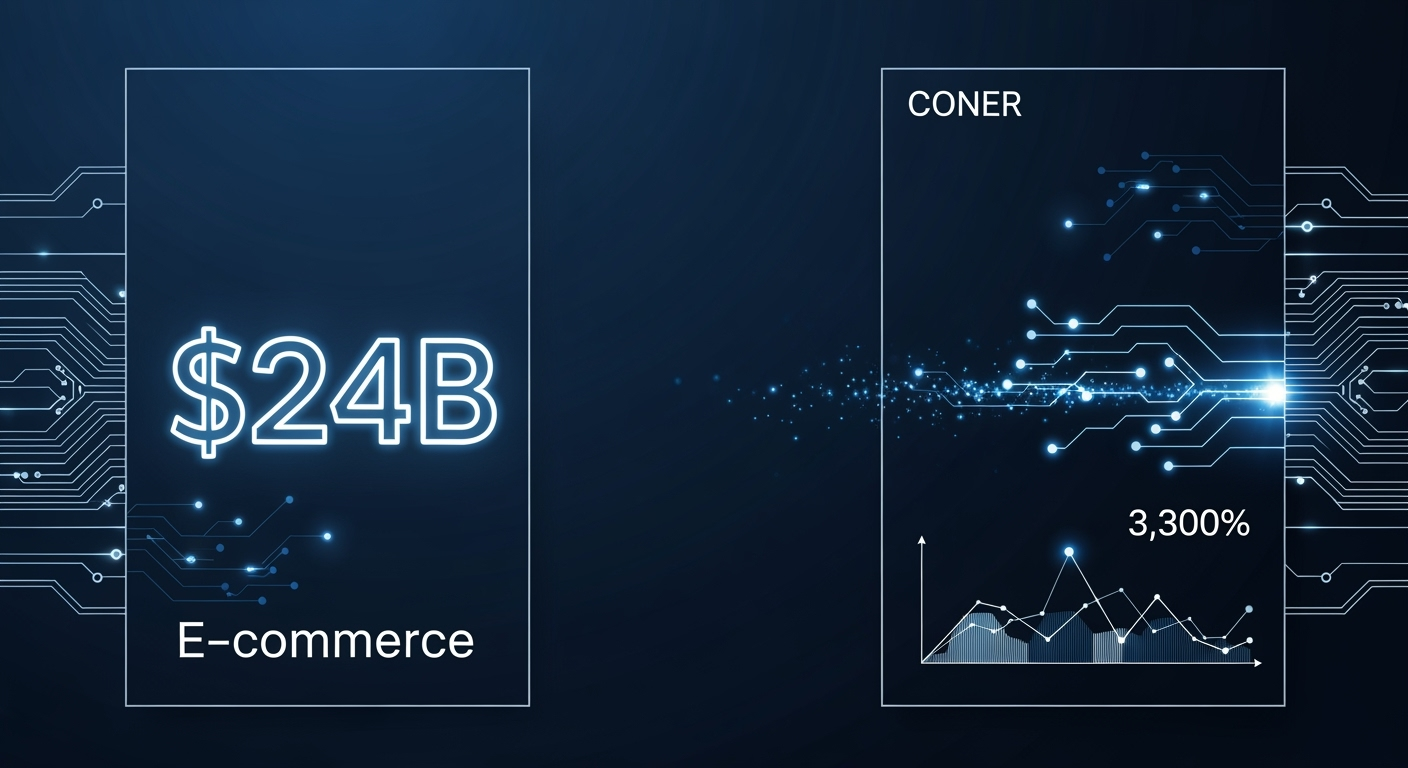

Prime Day 2025: U.S. E-Commerce Soars to $24B, GenAI Shopping Traffic Surges

Prime Day 2025: E-Commerce Booms and GenAI Shopping Grows Exponentially

Amazon's Prime Day 2025 has once again shaken up the U.S. e-commerce landscape, driving a record $24.1 billion in online sales over its newly extended four-day event. This translates to a staggering 30.3% year-over-year growth, making it comparable to two Black Fridays in a row. While steep discounts and exclusive offers drew millions of shoppers, the real story this year was the explosive rise in generative AI (GenAI) tools used by consumers for online shopping.

Generative AI Shopping Traffic Up 3,300%

According to a post-event analysis from Adobe Analytics, traffic to U.S. retail sites powered by GenAI, such as chatbots and AI browsers, soared by 3,300% compared to last year. This surge far exceeded Adobe’s initial forecasts, signaling a rapid shift in how consumers discover and buy products online. Despite this remarkable growth, AI-driven traffic is still smaller than traditional channels like email marketing or paid search, but its influence is clearly rising.

Breakdown of Key Sales Channels

- Paid Search: Accounted for 28.5% of U.S. e-commerce sales during Prime Day, up 5.6% from last year.

- Social Media Influencers: Drove 19.9% of online retail sales, a 15% increase year-over-year. Influencers were found to convert shoppers 10x more effectively than social media campaigns overall.

- GenAI Tools: Although their share is still growing, the year-over-year spike suggests shoppers are warming to AI-powered shopping assistants for discovering deals and making purchase decisions.

Prime Day Extends to Four Days

This year, Amazon expanded Prime Day to four days (July 8-11), making year-over-year comparisons challenging. Amazon itself did not disclose exact figures but confirmed it was the biggest event in its history, with more items sold than ever before. Third-party analysis reported by Adweek revealed that initial sales during the first two days were down 35% versus last year, but rebounded sharply, ending up 165% higher by the third day. This pattern suggests many shoppers waited for deeper discounts later in the sale.

Top-Selling Categories

Adobe’s analysis of over 1 trillion visits to U.S. retail sites highlighted several product categories that outperformed:

- Appliances: Online sales up 112% versus daily June averages

- Office Supplies: Up 105%

- Electronics: Up 95%

- Books: Up 81%

- Tools & Home Improvement: Up 76%

- Home & Garden: Up 58%

- Baby & Toddler: Up 55%

What This Means for Retailers and Brands

The 2025 Prime Day has firmly established GenAI tools as an emerging force in online retail, with shoppers increasingly turning to AI-powered assistants to find the best deals. While traditional channels like paid search and influencer marketing remain dominant, the huge jump in GenAI-driven traffic signals an important shift in consumer behavior that retailers and brands can’t afford to ignore.